Facilities Management Recruitment Market Outlook Q4 2023

We’re fast approaching Q4 of 2023, so here’s a few things to look out for in the market as we close out the year.

In recent years, the job market has largely favoured candidates, prompting employers to enhance their offerings to attract top talent. While many employers have proactively invested in training and development programs, sponsored relevant qualifications, and collaborated closely with the education sector, there's still a short-term challenge in finding candidates with the precise skills needed, especially in the FM, property, and infrastructure sectors.

However, this short-term challenge comes with its own set of opportunities. Employers now have a chance to reevaluate their requirements for open positions, focusing on the essential skills rather than just wish-list qualifications. This shift towards a more pragmatic approach can lead to quicker and more cost-effective hiring decisions.

The facilities management (FM) sector has continued to demonstrate remarkable resilience over the past five years. It has maintained stable growth throughout the pandemic-related disruptions to the markets, more so than many other industries. Moreover, the sector is experiencing renewed investment in social housing and is showing interest in decarbonisation projects, both of which will secure long-term future capital for the sector.

Candidates across FM, property and infrastructure continue to explore multiple job opportunities at once. To work with this and not miss out, it's essential for employers to engage candidates throughout the recruitment process, demonstrating their commitment to bringing them on board. Counter-offers have become commonplace, so it's crucial to support new hires through their notice periods to ensure a smooth transition.

Inflation has remained persistently high in the UK economy, prompting employers to increase salaries to attract top talent. While this has temporarily slowed vacancy growth and led to some hiring freezes and redundancies, it's also broadened the labour supply, giving employers a bit more choice going into the end of the year. However, it will take time before they can be truly selective.

Beyond salary, candidates are increasingly considering the overall package offered by employers. Generous benefits and flexibility often weigh as heavily as monetary compensation. Employees are now comparing offers from multiple companies, including their current employers.

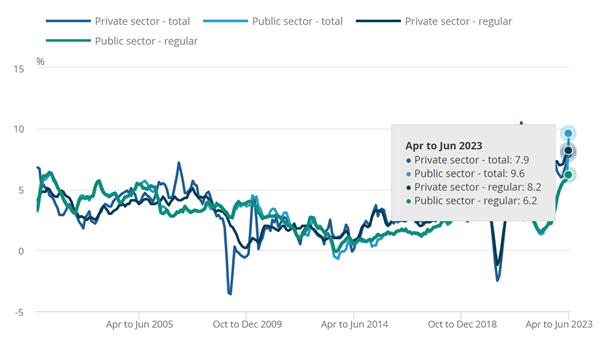

The recent data paints an encouraging picture: "Annual average regular pay growth for the private sector was 8.2% in April to June 2023, and 6.2% for the public sector."

Looking ahead, the medium-term prospects are even more promising. Many universities and higher education providers are introducing specialized degrees and further education qualifications in construction, infrastructure, sustainability, and CSR-related fields. This educational investment will boost the talent pipeline, addressing the skills gap that has been a concern.

In conclusion, as we approach Q4 of 2023, the market presents a mix of challenges and opportunities for both employers and candidates. By adopting a pragmatic approach to hiring, investing in employee support, and recognising the value of comprehensive benefit packages, employers can navigate the current landscape successfully. Each of these things can be achieved with real collaboration between companies and their recruitment partners. With the medium-term outlook showing promise in terms of talent development, there's every reason to remain optimistic about the future.